Wednesday, July 13, 2022

Electric Vehicle Update and Potential Gasoline/Convenience Store M&A Impact

Source: Observations from the Executive Suite

By Jeff Kramer, Managing Director, NRC Realty & Capital AdvisorsIt should seem clear to everyone by now that the automobile industry and related businesses are going through what some are describing as the "biggest industrial transformation in America". Going back to the days of Henry Ford, America has always been first and foremost in automotive technology and industrial productivity, even though many components are now made and assembled inexpensively overseas with still cheap fuel and labor. For any number of reasons, the economics have changed significantly, and most recently Covid has exposed shortcomings of many of the cost savings benefits from "just-in-time inventory" and even added to shortages of key products and components. Now U.S. and strong foreign auto companies are trying to bring production back to America, or perhaps I should say North America to include lower cost Mexico and possibly Canada. Regardless of the merits or causes of "climate change", the U.S. seems committed to green energy solutions that include non-carbon-based fuels. We lost a great deal of competitive position to China by not recognizing the future importance of solar power generation, and it seems Detroit does not want to lose its worldwide leadership position to China next.

Consider some recent statistics to see where electric vehicle production stands at this time:

- Electric car vehicle (EV) sales, which include plug in hybrids (PHEV) at 28% of all EV sales' comprised about 12% market share of worldwide vehicle sales in May 2022. China led with 31%, Europe at 19%, and the U.S. was about 6%, of which Tesla was 70%. These market share numbers are up 55% from May 2021 and are in spite of Covid shutdowns in much of China. A common forecast has been that the 12% worldwide number will grow to 25% market share by 2025, which is higher than projected last year based on recent announcements IF they can be achieved in our crazy world. China will lead this growth while everyone else will be trying to catch up. Fortunately for us in the U.S., the cars are needed in China and might not be imported here. Tesla does well in China, despite the many challenges, and they are still seeking new sites in the U.S. in addition to their new mega plant in Austin. Tesla has been reducing production schedules in some locations recently, perhaps due to slowing economies and product shortages, but perhaps also due to growing competition at least in China.

- Technology by private industry is changing quickly, even though many governments have not. Of note, Toyota, Volkswagen and BMW are working with a U.S. company for a completely solid state battery, much lighter and potentially less expensive with scale of production. They are about two years behind right now. Chevron has been largely dedicated to pure hydrogen-based fuel technology, which might be very economical especially in denser populations like California. And automated vehicles, including trucks, hold the hope of significant labor cost savings. Just like Covid vaccine technology, free markets work!

- A new partnership was announced today by Pilot Company which will facilitate the creation of a coast-to-coast electric-vehicle charging network in perhaps one of the most ambitious undertakings by a single retailer. Pilot has partnered with automobile manufacturer General Motors and charging network EVgo to build out a network of 350-kilowatt EV chargers at many its travel-center locations across the United States.

Overall, as Henry Ford discovered, scale is critical to offering a competitive price, and in his era, newly discovered cheap hydrocarbon fuels beat out electric. Depending on many factors even independent of climate change effects, electric car plants are quicker and cheaper to build, cars may cost less to fuel, and ongoing maintenance looks much cheaper because of fewer parts. Plus electric cars are fun to drive and are fast. One huge remaining question is the potential strain on the electric power industry, which has its own uncertainties and may face large differences by state. So, has the tide turned forever? The car companies seem to think so based on announcements, but they know the public will eventually vote with their pocketbooks. We'll see, as there will be many bumps in the road, including the number of potential competitors, which even includes tech companies like Apple. At one point early in the buildout of the original auto industry, there were as many as 60 competitors. The good old gasoline station has already changed for most of us in huge ways.

Covid effects notwithstanding, for most of us, more gross margin is obtained now from convenience store sales and foodservice, particularly in our strong chains. Being deemed an "essential industry" brought huge pricing power to our industry, and others too, quite frankly. Covid brought us new customers, higher rings, and gave a chance to show our "stuff" and the importance of convenience.

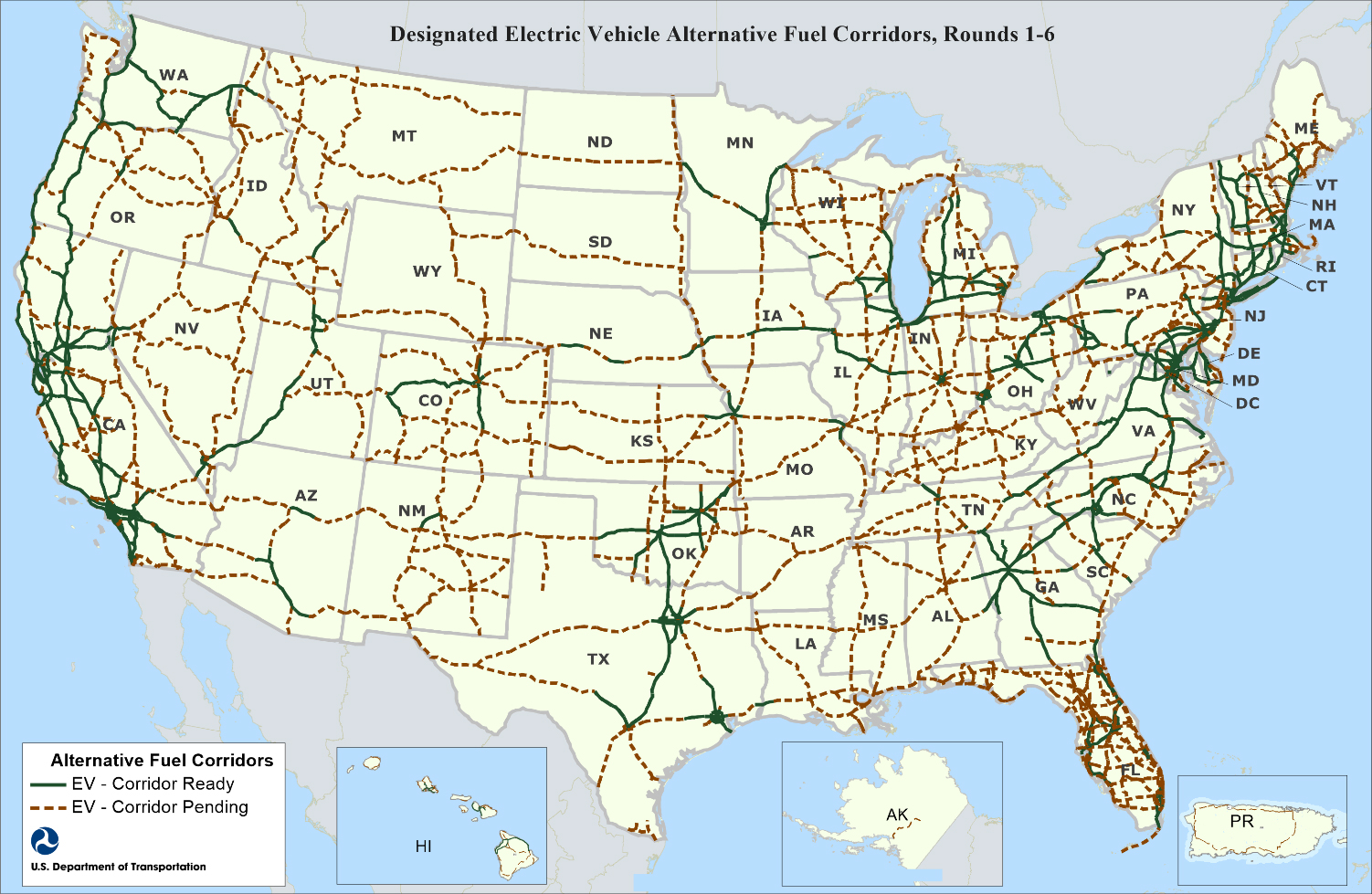

My concern for some time has been that most electric fueling will not be nearly as convenient at our stores because of the idle time spent charging, which will be far more convenient and probably cheaper at home at night and at longer stay venues like grocery stores or entertainment centers. At home charging may even bring the ability to draw power from the car or truck (Ford F-150) for temporary power outage backup. Will improving technology allow us to compete on the "cost to charge" and the "time to charge" before we permanently lose the EV customer? Note that the U.S. Department of Transportation's Federal Highway Administration just published the map below to "set up Corridors to serve as the backbone for the national electric vehicle charging network." I'm not certain if the Administration has that authority, but I guess we'll find out!

So, if a site loses traffic count on its forecourt, will it be enough of a destination to draw customers to purchase convenience and foodservice items? Many c-store items today are impulse purchases. If fuel volumes decline as they have been, will the location be able to keep raising prices on fuel and/or other remaining sales items? Hard to say, especially if the economic future in general brings more competition, internet included. Companies such as Wawa and Sheetz have been focusing their site selections around foodservice for some time. The most notable freeway-oriented competitor to watch these days is Buc-ees. They offer an excellent, fresh, varied food program and snacks in a store as large as 67,000 square feet, plus a large variety-store type offering to keep the family occupied for longer EV charging times. A true destination. Luckily, they are building them at a measured pace so far, but others will follow. One thing for sure is that strong stores and chains typically need a much lower fuel gross margin per gallon to break even, per NACS SOI (State of the Industry) statistics.

What can we do as gasoline marketers? Company valuations are affected by earnings AND multiples, and can be compounded through movements in the same direction from both factors working at the same time.

- Follow every economic automation niche to control store and back room expenses.

- Take very good care of your remaining employees. Turnover is expensive.

- Religiously track your sales data to keep up with your market, recognizing that it can change quickly with competition, costs, the economy and marketing trends. Test pricing strategies and the interaction of forecourt versus store pricing.

- Recognize and promote your strengths constantly.

- Always look for new products, deals, loyalty programs, new profit centers like car washes, gaming machines, etc.

- Upgrade stores where economics justify, including electric charging stations, of course.

- Foodservice can make you a destination while charging.

- Consider a franchise or dealer operation, at least for some stores.

- Close or sell losing stores. Everyone has them or will have them in a more competitive environment.

- Free money is history. Keep debt at a minimum and conserve cash for opportunities.

- Consider joint ventures with other companies. Oil companies with expensive refineries will continue to have a lot of hydrocarbon fuels to sell for many years.

- Recognize your competitive position and management succession in your company.

Some may choose to sell and move on, as much higher interest rates are providing investment opportunities which should give a better return than recently. Taxes may not go higher, but they certainly will not go down. Our industry, for one, has been blessed with an incredibly favorable overall tax situation.

In summary, still a great, resilient industry, but like all of them, changing. The subject of EV development will be getting much more press as more and more new vehicles will be introduced in the U.S. market starting this fall. Despite guaranteed hiccups along the way, the ongoing Ukraine War has added further emphasis to the "going green" movement in general as Europe weans itself from Russian oil and gas.

–

To see a list of convenience stores and gas stations for sale, click here.